Tag behavioral finance

In yesterday’s post, we compared male and female fund managers. Our main take-aways: Funds of female managers are considerably smaller, slightly more expensive, and have smaller turnover. Female fund managers take on less unsystematic risk Today for International Women’s Day,… Continue Reading →

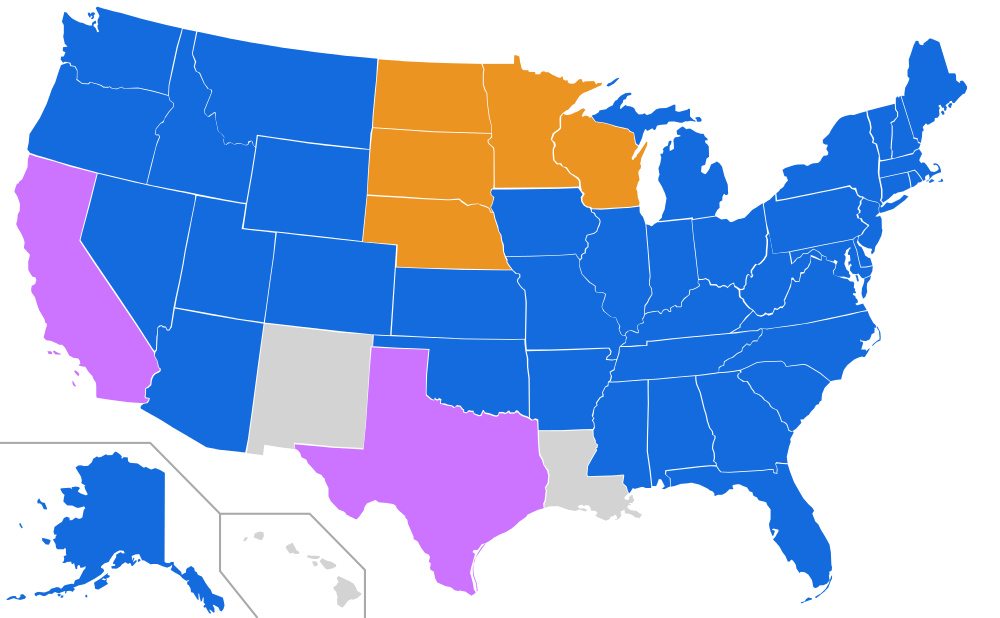

In previous posts (see here and here), we discussed how female and male managers may differ in their investment behavior. Today, we consider the other side: the investors. How do investors select funds to invest in? Do they base their… Continue Reading →

US economist Richard Thaler has been awarded the Nobel prize in economics in 2017. The Royal Swedish Academy stated that Thaler receives the award “for his contributions to behavioral economics”. How does this contribution look?

July 2017 – what a weather ride! First, temperatures up to 37 degrees Celsius in Stuttgart. Then, downpours for days on end. How did this affect you – apart from having to change plans for outings at short notice, or… Continue Reading →

Forecasting returns is the holy grail of investment – and finance researchers are also interested in whether returns can be predicted because it tells us whether markets are “informationally efficient” (and thinking about this has been rewarded with a Nobel… Continue Reading →