In previous posts (see here and here), we discussed how female and male managers may differ in their investment behavior. Today, we consider the other side: the investors. How do investors select funds to invest in? Do they base their investments on a manager’s past performance? Or do they base their decisions on other manager characteristics?

Biased decisions based on manager gender

We already discussed that female mutual fund managers receive smaller inflows compared to their male colleagues. Hence, investors appear to select fund manager based on gender. This decision is not rational: female and male fund managers generate the same performance. Apparently, individual investors show a gender bias in their investment decision.

Other characteristics to decide on?

In their 2015 Review of Financial Studies paper “What’s in a Name? Mutual Fund Flows When Managers Have Foreign-Sounding Names”, Kumar, Niessen-Ruenzi, and Spalt explore another bias. Their focus: does the name of a fund manager influence investors’ decisions? Does it make a difference when managers have foreign-sounding names?

Identifying foreign-sounding names

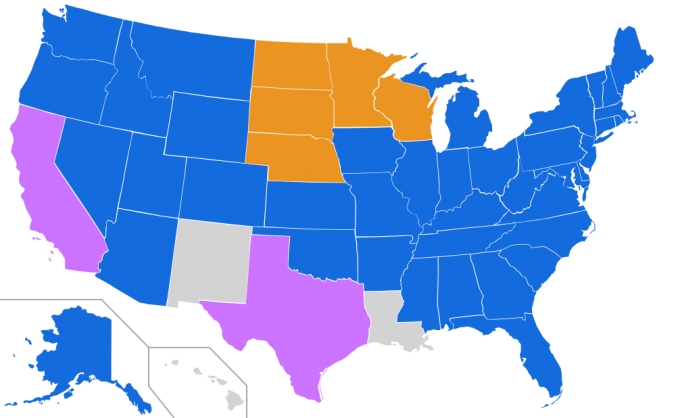

The first challenge the authors address is to figure out whether investors perceive a manager name as foreign. To do this, they conduct a survey via the Amazon Mechanical Turk platform for their sample of 150 manager names. Participants were asked to indicate whether a name sounds foreign. Then, the authors created a dummy variable called Foreign75. This variable takes on a value of one if 75% of the survey participants perceived the name as foreign.

Lower inflows for managers with foreign-sounding names

In the second step, the authors analyze fund flows for manager with foreign-sounding names and the rest of the sample. They find that funds receive economically significant less flows when manager names sound foreign. Table 1 gives the results of a basic OLS regression with flows as the dependent variable and Foreign75 as the explanatory variable.

| Fund flows | Fund flows | |

| Foreign75 | -0.098 | -0.087 |

| Lagged fund flows | no | yes |

Table 1: Regression results fund flows. Source: Table 2 Panel A of Kumar et al. (2015). Bold font indicates significance at the 1% level.

Table 1 shows that flows are significantly lower by 9 to 10 percentage points for funds managed by managers with foreign-sounding names. With a mean of about 20% per year, this difference is economically huge!

No differences in performance, or fund or manager properties

And this is not due to a performance difference. For a range of performance measures, there is no systematic difference between managers with foreign-sounding names and other managers. Hence, there is no rational reason to prefer the second group of funds. The authors conclude that the differences are due to taste-based discrimination. To rule out differences between the funds, or by other manager characteristics, as an alternative explanation, the authors run a matched sample analysis. Even when they compare only funds with similar age, size, and manager education, the result stays the same. Fund flows are significantly lower when the manager has a foreign-sounding name.

In a nutshell: Social biases drive investor decisions

To sum up, managers with foreign-sounding names receive lower flows. This is not due to fund differences, education, or performance: All test results indicate that discrimination and social biases affect investors’ decision making.

You may also like