What is the relation between central clearing and counterparty risk? Intuitively, it seems clear that a central clearing counterparty (CCP) improves the netting mechanism. With bilateral clearing, two trading partners can only net with one another. With central clearing, the CCP can net the exposures of all trading partners. But here’s the challenge: a CCP may offer clearing for some asset classes (say, interest rate contracts) but not for others (say, FX contracts).

Hence, bilateral clearing may be more efficient since trading partners can net their bilateral exposures across all asset classes. The upside? Better netting means less counterparty risk.

What can theory tell us about central clearing and counterparty risk?

In their 2011 Review of Asset Pricing Studies article “Does a Central Clearing Counterparty Reduce Counterparty Risk?”, Duffie and Zhu show when a CCP improve clearing efficiency. To keep the analysis simple, they first assume that all market participants bear the same risk in every asset class. Intuitively, a CCP leads to a better outcome if there are many traders (N), or only few asset classes (K). Formally, Duffie and Zhu show that the following relation must hold if the CCP reduces counterparty risk:

What does the real-world data say?

So, how does the relation between central clearing and counterparty risk look in the real world? Can we expect that a switch from bilateral to central clearing improves netting, and decreases counterparty risk?

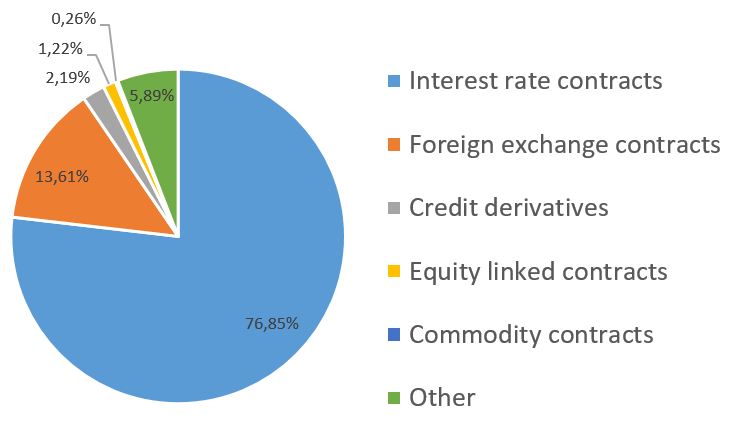

Figure 1 gives an overview over the main OTC derivatives. Even the biggest CCP skeptic would probably agree that there are not more than six separate asset classes which play a role. So, let’s set K=6. At the same time, 90% of trading in OTC derivatives markets is due to 16 major global banks – the so-called G16. Hence, let’s set N=16. Therefore, the right-hand side of Equation (1) evaluates at 16^2/(4*15)=256/60, which is roughly 4.27 – unquestionably less than 6. So: introducing a CCP means that netting would become less efficient, and counterparty risk higher.

Adding heterogeneity to the mix…

How crucial is the assumption that market participants are “identical” to arrive at this conclusion about central clearing and counterparty risk? Actually, quite substantial! To show this, Duffie and Zhu introduce a new variable R to measure how much a particular asset class (say, credit default swaps / CDS) contributes to the total market risk notional-wise. In this case, a CCP improves netting efficiency (and counterparty risk) if

Given the market share of G16 dealers, this suggests that R needs to be larger than 0.5533. So, going back to Figure 1, moving interest rate contracts (market share of 77%) to a CCP would already increase netting efficiency. Which is probably why interest rate swaps are already centrally cleared. Moving another asset class (say again, CDS) to a CCP, on the other hand, will not improve netting efficiency. The only exception: mandatory clearing of all asset classes.

The bottom line

If the clearing decision is left up to the market participants, markets with a CCP can actually be worse than markets without the option of central clearing!

You may also like