With a total volume of 1.4 trn EUR to date, the ECB’s public sector purchase programme (PSPP) has been blamed for low interest rates for depositors, excess liquidity, housing price bubbles, global warming – well, maybe not the last. The newest theory: Mario Draghi uses PSPP to manage spreads between Eurozone countries (Eurozone spreads).

In today’s Fact&Figure, we consider the spread between Germany and France.

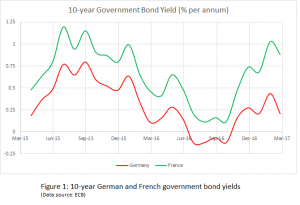

Government Bond Yields

Figure 1 displays the yields for German (red) and French (green) 10-year government bonds since the beginning of the PSPP in March 2015.

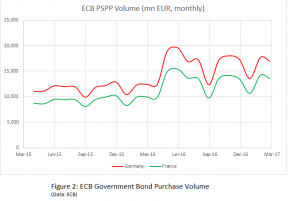

ECB Purchase Volume

Figure 2 displays the monthly purchase volumes for German (red) and French (green) public sector securities. (You can find the data here.)

Excess Demand and Interest Rate Spreads

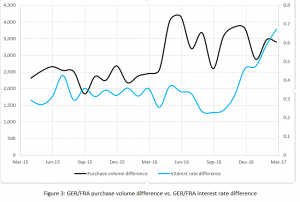

Now, is the ECB using purchase volume to drive up the spread of French over German bonds? In general, interest rates decrease if the ECB purchases more: higher demand pressure increases bond prices, and decreases yields. Hence, the ECB could drive up the French-German spread by purchasing relatively more German bonds.

Figure 3 displays the French-German spread (blue line, interest rate France minus interest rate Germany) vs. the excess purchase volume of German public sector securities (black line, purchase volume German securities minus purchase volume French securities). Clearly, the ECB increased the purchase volume for German securities in April 2016 – but spreads were stable around that time. The upwards-trend in spreads starts six months later, in October 2016 – with no apparent trend in excess purchase volume.

In summary: global warming isn’t Mario Draghi’s fault, nor are the increasing spreads for French government bonds!

You may also like