Why do investors engage in credit default swap (CDS) trading? At first glance, you would assume that the main motive is to obtain protection against default risk. But of course, a CDS is a bilateral contract: for every protection buyer (who purchases insurance against the underlying reference entity’s default), there must be a protection seller.

The protection seller’s motive cannot be to obtain protection – she effectively increases her risk exposure against the underlying. So, are protection sellers speculators? Do they take on credit risk to diversify their pre-existing risk exposures? Or are there other CDS trading motives?

The anatomy of the CDS market

In their 2017 paper “The Anatomy of the CDS Market” published in the Review of Financial Studies, Oehmke and Zawadowski tackle the question of CDS trading motives. To do so, they relate properties of the underlying reference entity to trading activity in a specific CDS contract. They measure trading activity at the weekly level via two publicly available proxies: net notional amount outstanding and market risk transfer activity (how much net protection was bought/sold). Both statistics are published weekly by the Depository Trust and Clearing Corporation (DTCC).

Four main drivers of trading activity:

Oehmke and Zawadoski identify four main drivers of CDS trading activity: hedging, speculation, trading frictions in the underlying bond market, and arbitrage. How do they provide evidence for these CDS trading motives?

Hedging,…

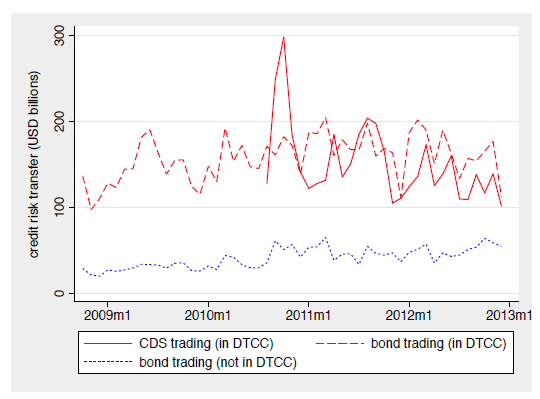

The more debt (bonds, loans, accounts payable) a firm has, the higher is the CDS trading activity. This is sensible: with a higher exposure of the market to the firm’s default risk comes more need to hedge this exposure. Figure 1 shows the comovement between corporate debt trading volume and CDS trading volume.

Figure 1: Trading volume in CDS (red solid line) and bonds (red dashed line), reproduced from Oehmke and Zawadowski (2017)

…, speculation and frictions, …

Oehmke and Zawadowski identify speculation and frictions as additional CDS trading motives. First, CDS on firms where analysts disagree more about the underlying firm’s future earnings trade more actively. An interesting aside: This relation only holds for CDS, not for bonds. Second, bond markets are highly fragmented, and bonds issued by the same firm give rise to very different cash flows. This leads to high transaction costs in the bond markets. Investors who want to hedge or speculate therefore find CDS attractive because of their higher standardization. Instead of buying or selling a bond, investors sell or buy protection in a CDS. This effect draws funds from the bond market and makes the CDS market more liquid

…, and arbitrage opportunities

To measure the extent of arbitrage opportunities, Oehmke and Zawadowski analyze the the CDS-bond basis. The basis equals the CDS spread (s) minus the bond yield in excess of the risk-free rate (ys). Simply put, the basis should be zero because if you buy a bond and protection via a CDS, you have eliminated the underlying’s default risk. If the basis is negative, you can buy protection at the spread (-s), earn the bond yield spread (+ys), and realize a positive risk-free profit (-s+ys). In line with this intuition, Oehmke and Zawadoski show that a negative CDS-bond basis positively affects CDS trading volume.

Take-away: Many CDS trading motives

In summary, Oehmke and Zawadowski’s results highlight the benefits of CDS markets. Yes, investors use CDS to speculate, but also for hedging. If we shut down CDS markets, bond investors could not hedge. Consequently, they would hold fewer risky bonds, increasing cost-of-capital for firms and leading to fire-sales of bonds in case of an immediate credit risk deterioration. In conclusion, the CDS market is important for the functioning of financial markets.

You may also like