In our previous post, we discussed the Santa Claus Rally: higher returns between Christmas and the end of the first week of January compared to the rest of the year. Admittedly, 2018 was not the best year for DAX30 investors with an annual return of -17%. Hence, in our first post this year, we revisit the effect documented by Nippani, Washer, and Johnson – the Santa Claus rally revisited!

The 2018/2019 Santa Claus Effect

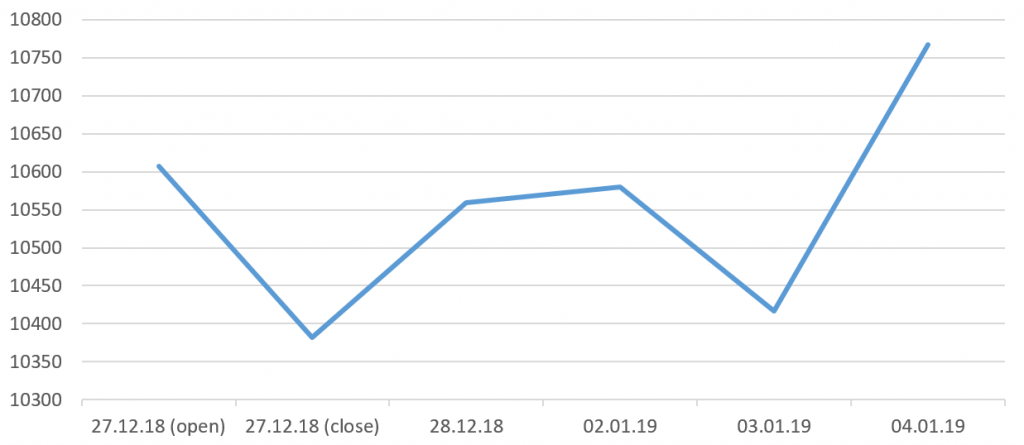

We collect daily DAX30 index open and close values between December 27, 2018 and January 4, 2019. Figure 1 shows the index values.

Assume that you invested in the DAX at the opening price of December 27, immediately after the holidays. This investment generates a return of 1.51% until end of January 4. This corresponds to an average daily return of 27 bps.

Comparing to the Rest of the Year…

This return is considerably higher than the average daily return during the rest of the year 2018 (-7 bps). Also, returns were positive on three out of five trading days during the Santa Claus rally, compared to 121 out of 248 during the rest of the year. So, our very-small-sample analysis is in line with the results of Nippani and coauthors.

Take-away: A Year Like Any Other

Naturally, even a systematic market anomaly is not a guarantee for positive results every year. But at least our analysis shows that 2018, in spite of its negative DAX30 returns, offered investors a small Christmas present at the end of the year.

You may also like