Four weeks ago, the European Securities and Markets Authority (ESMA) has recognized three central clearing counterparties (CCPs) from the United Kingdom – which will allow them to offer clearing services in the EU in case of a hard Brexit. Why is this so important?

CCPs matter!

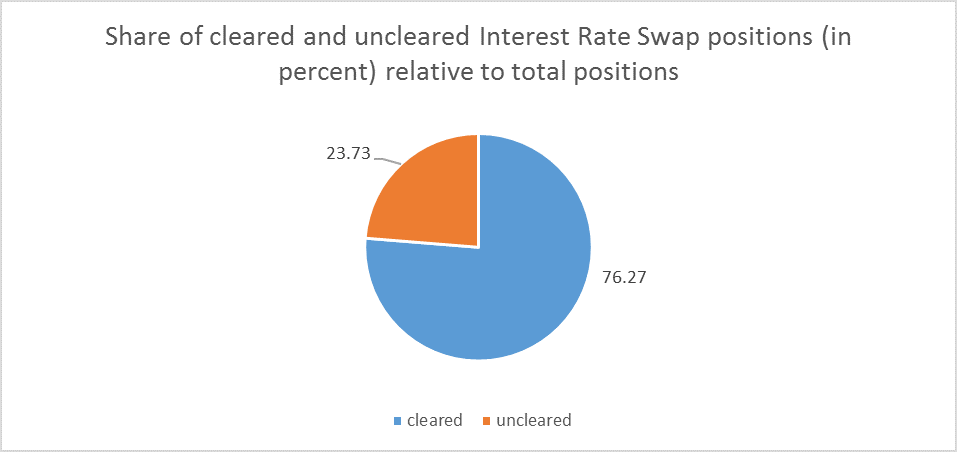

CCPs are a crucial part of the current global financial market infrastructure. Especially on the market for interest rate swaps (IRS), central clearing has become the dominant clearing type. Figure 1 shows that more than 75% of all interest rate derivatives gross positions are held by central clearing counterparties.

Clearing in London

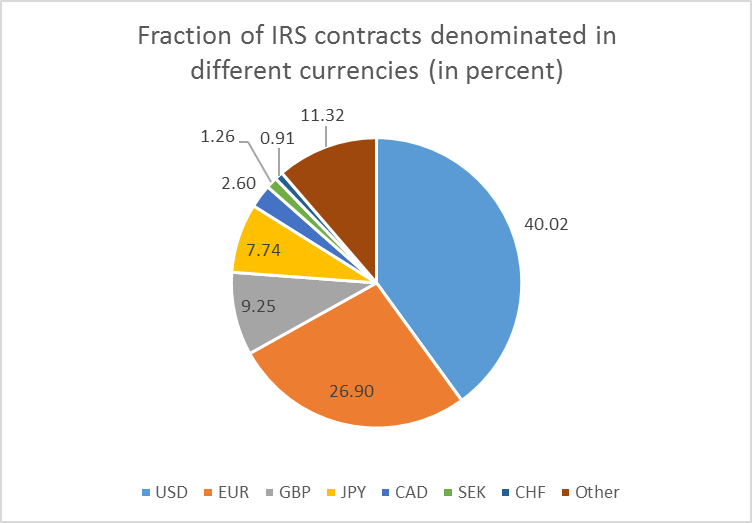

The most important CCP, LCH Clearnet, is located in … London! Effectively, LCH clears more than 90% of all IRS. Amont all contracts, Euro-denominated IRS are the second-largest position (see Figure 2). Hence, it’s safe to assume that many European firms use the clearing services of LCH.

EMIR regulations

Under the current European Market Infrastructure Regulation (EMIR), European firms must centrally clear IRS through a CCP that resides in the EU or is recognized by the ESMA. For the recognition, legal and supervisory mechanisms for CCPs must be comparable to EU regulation. Requirements for systemically relevant CCPs are even stricter. The EU commission may even require a seat in the EU for such systemically relevant CCPs.

Where to clear post-Brexit?

The problem of central clearing in post-Brexit times: Central clearing of IRS without LCH is basically no option in the short-term:

- Clearing requires expertise in the specific asset class and benefits strongly from economies of scale.

- The shift of large volumes in IRS to another CCP could cause financial instability due to bank losses and suboptimal CCP risk management.

In summary, prohibiting clearing via LCH is not an option: EU firms simply would not know where to go.

Take-away: Cutting off LCH is not feasible

Having recognized LCH as a third-country CCP ensures that European market participants are not cut off from IRS clearing services. It is not necessary for LCH to offer its services from within the EU, although it is hard to argue that LCH is not of high systemic relevance. However, practitioners (e.g., German central bank board member Joachim Wuermeling) expect the current solution to be transitory, such that ESMA will require clearing services from within the EU eventually. It is not clear yet how this will happen: Will a European clearinghouse arise? Or will UK CCPs expand their clearing infrastructure to continental Europe? Both solutions could lead to a fragmentation of the IRS market, resulting in decreasing economies of scale:

- fewer netting opportunities, and consequently,

- higher costs for clearing members and their clients (e.g. higher collateral requirements).

Leave a Reply