In yesterday’s post, we compared male and female fund managers. Our main take-aways: Funds of female managers are considerably smaller, slightly more expensive, and have smaller turnover.

Female fund managers take on less unsystematic risk

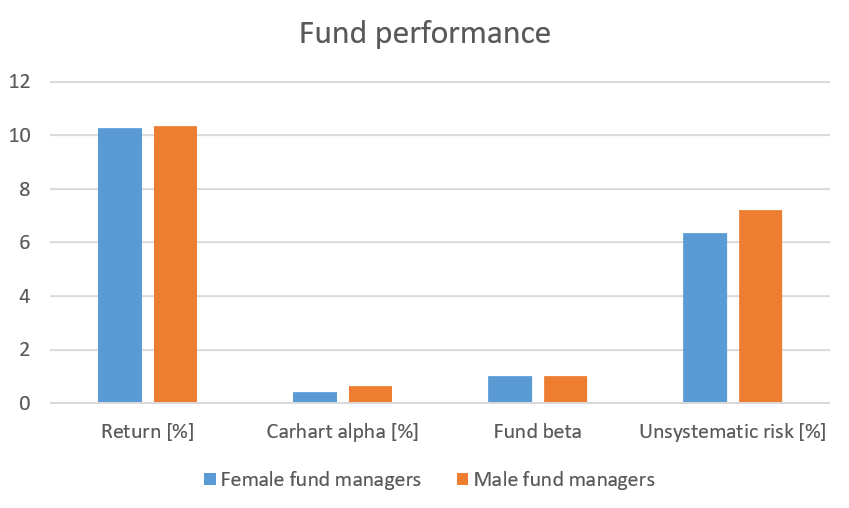

Today for International Women’s Day, we look at the performance – namely, risk and return of the funds. We display return, risk-adjusted return (Carhart alpha), and systematic (fund market beta) as well as unsystematic risk (return standard deviation after adjusting for systematic risk) for mutual funds with female and male managers in Figure 1.

Figure 1: Performance differences

Figure 1 shows that return, risk-adjusted return and systematic fund risk are the same for female and male fund managers. But unsystematic risk differs: After adjusting for systematic risk, funds of female fund managers have a return standard deviation of 6.34% per year. Funds of male managers, on the other hand, have a return standard deviation of 7.20% per year. So, male manager take riskier bets in their portfolios. These risky bets do not pay off on average, since the returns are the same. This is not surprising, since one implication of the Capital Asset Pricing Model is that you only get compensation for taking on systematic risk.

Female fund managers‘ temperament

So far, we have documented that female fund managers act differently than their male colleagues in two ways. First, female fund managers trade less. Second, they take on less unsystematic risk. We now combine these observations with the idea that women are “temperamentally“ better suited as investors. Anecdotal evidence supports such a hypothesis.

As an example, take Baillie Gifford’s Sarah Whitley who will retire in April 2018 after her stellar performance in the firm’s Japa investment trust . In a 2015 interview with Thisismoney.co.uk, she stated that „you have to avoid the noise that the markets give you“ and „it’s easy to spend a lot of time worrying about what the market is saying, and what you really need to be worrying about is what is your view[…].“ Similarly, Investec’s emerging market bond fund manager Victoria Harling pointed out in an interview with Citywire Selector that focusing „on news flow not headline noise“ is key to her investment strategy.

As an example, take Baillie Gifford’s Sarah Whitley who will retire in April 2018 after her stellar performance in the firm’s Japa investment trust . In a 2015 interview with Thisismoney.co.uk, she stated that „you have to avoid the noise that the markets give you“ and „it’s easy to spend a lot of time worrying about what the market is saying, and what you really need to be worrying about is what is your view[…].“ Similarly, Investec’s emerging market bond fund manager Victoria Harling pointed out in an interview with Citywire Selector that focusing „on news flow not headline noise“ is key to her investment strategy.

Female fund managers trade less when sentiment decreases…

To test whether female fund managers actually react less to sentiment shocks, we run a regression with fund turnover as the dependent variable. The main variables are a dummy variable whether a fund is managed by a female manager, a sentiment shock measure, and the interaction between the two as the main explanatory variables. As a sentiment shock measure, we use changes in the VIX, with increases signaling a negative sentiment shock. We use fund and manager control variables to adjust for other sources of different behavior. Table 1 displays the regression results.

| Female manager | Sentiment shock | Female manager * Sentiment shock | |

| Turnover [%] | -24.18 *** | 1.90 *** | -1.27 * |

Table 1: Impact of sentiment shocks on turnover for funds managed by male and female fund managers. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level.

Table 1 verifies the result of yesterday’s post that female fund managers generally trade signficantly less than male fund managers on average. When a negative sentiment shock hits the market, both male and female fund managers trade more, but there is a significant difference: Male fund managers increase turnover by 1.90%. Female fund managers only increase turnover by 1.90% -1.27% = 0.63%.

…, keeping portfolio risk in check….

How do managers adjust their portfolios as a reaction to sentiment shocks? To check whether female fund managers react differently from their male colleagues, we run a second linear regression. We use risk (total fund risk, systematic risk , and unsystematic risk) as the dependent variable. The explanatory variables are as in the previous regression. We display the results in Table 2.

| Female manager | Sentiment shock | Female manager * Sentiment shock | |

| Fund risk [%] | -0.10 | 0.25 *** | -0.05 *** |

| Systematic risk | 0.86 | -0.60 *** | -0.38 |

| Unsystematic risk | -0.94 | 0.40 *** | -0.15 *** |

Table 2: Impact of sentiment shocks on risk for funds managed by male and female fund managers. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level.

Table 2 shows that both male and female managers increase unsystematic risk, and thus total fund risk, when a negative sentiment shock hits. But female managers increase risk systematically less: male managers increase unsystematic risk by 0.40%, female managers only by 0.25%. As a result, total fund risk of female-managed fund increases by 20% (0.20% vs. 0.25%) less than in male-managed funds.

… and thus avoid negative performance consequences

What are the performance consequences of the different risk-taking? We explore this in our last linear regression. The dependent variable is performance, measured as return or risk-adjusted return (Carhart alpha). The explanatory variables are as in the previous regressions. Table 3 gives the results.

| Female manager | Sentiment shock | Female manager * sentiment shock | |

| Return | -0.89 | -0.92 *** | 0.30 * |

| Risk-adjusted return | -0.34 | -0.08 *** | 0.05 ** |

Table 3: Impact of sentiment shocks on performance for funds managed by male and female fund managers. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level.

Table 3 shows that the weaker reaction of female fund managers limits the performance loss. Male fund managers lose about 0.92% return, and 8 bps risk-adjusted return, after a performance shock as they move from systematic to unsystematic risk. Female fund managers, on the other hand, only lose 0.62% of return and 3 bps of risk-adjusted return.

Take-away: Female fund managers are more resilient against sentiment shocks!

The basic take-away of our analysis: Female fund managers react less to sentiment shocks than their male colleagues. Their resiliency against these shocks leads to less unsystematic risk in the fund portfolio, and thus to better performance consequences. In a nutshell: When push comes to shove, put your portfolio into a woman’s hands!

You may also like