How do you measure institutional investor attention? Aggregate attention is easier to capture. You can look at trading volume (which reflects the transactions of all investors) as an indirect measure. You can look at front-page articles in influential newspaper as a measure of how much information is provided. And you can look at Google Search Volume as a measure of how much information investors require.

But what about measuring institutional investor attention? How do you “tease out” this specific attention? You go to information sources predominantly used by these investors!

Screen out retail investors through Bloomberg!

In their 2017 Review of Financial Studies article “It Depends on Where You Search: Institutional Investor Attention and Underreaction to News”, Ben Rephael, Da, and Israelsen use data on search and reading activities on Bloomberg terminals. How does this help? Access to Bloomberg terminals is extremely costly (thanks to the DALAHO for shouldering this cost at the University of Hohenheim!!!). Hence, most Bloomberg users are investment professionals: traders, analysts, etc.

How influential is a Bloomberg news article?

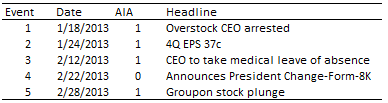

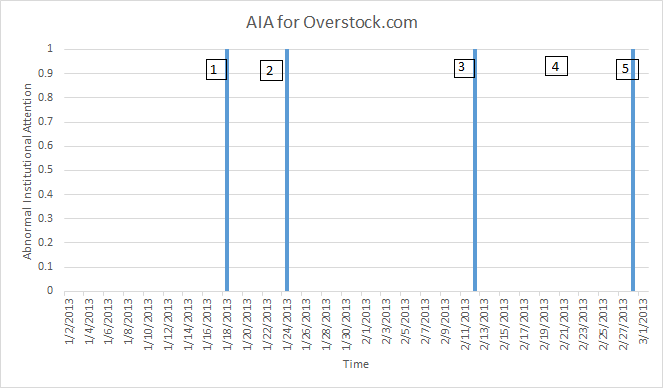

Bloomberg continually assesses how many users access their news articles. To indicate this, Bloomberg assigns an internal numerical score to its news articles. Ben-Rephael and coauthors use this classification to measure “Abnormal Institutional Attention” via the dummy variable AIA. AIA takes on a value of one if an article recently jumped to the high interest group. Figures 1 and 2 show a timeline of newsworthy events for internet retailer Overstock, Inc. and the dummy variable AIA.

Figure 1: Timeline of Overstock, Inc. events. Reproduced from Ben-Rephael et al. (2017).

Figure 2: Timeline of Abnormal Investor Attention for Overstock, Inc. events. Reproduced from Ben-Rephael et al. (2017).

The figures show that a jump of AIA to from zero to one coincides with news regarding Ovestock, Inc. in 4 of the 5 cases. The news are rather different and vary from earnings announcement to the arrest of the CEO for allegedly carrying a gun through airport security. Hence, AIA clearly captures the attention.

Measuring institutional investor attention

Developing the AIA index is the authors’ main contribution. Therefore, the authors provide empirical evidence that AIA actually measures what it is supposed to: investor attention.

- They show that AIA increases significantly around earnings announcements, recommendation changes, and when firms exhibit extreme returns.

- Similarly, AIA is higher for larger firms, firms with greater analyst coverage, and after the weekends.

All this agrees with the AIA as a measure of institutional investor attention.

Take-away: When looking for institutional investor information, go where they are!

In summary: AIA offers a new way to exploring, studying and measuring institutional investor attention. And it is important to measure retail and institutional investor attention separately. For example, institutional investors’ stock ownership has surged in recent years. Therefore, trading volume nowadays almost exclusively depends on institutional investors. But how different are measures of institutional and retail investor attention? Ben-Rephael et al. (2017) find that AIA and Google Search Volume explain only 2% of each other’s variation – they are basically uncorrelated. Hence, it matters how we measure investor attention.

You may also like