Can television news affect stock prices? And does the price impact of tv news depend on who presents the news? Both of these effects would contradict the Efficient Market Hypothesis (EMH). Put simply, the EMH states that security prices immediately reflect all available information.

“Market efficiency in real time”

Busse and Green investigate these two question in their 2002 Journal of Financial Economics paper “Market efficiency in real time”. They analyze the impact of CNBC’s Morning (presented by Consuelo Mack) and Midday Call news segment (presented by the more popular and experienced news anchor Maria Bartiromo) on stock prices. What kind of information do these segments offer? Basically, the news anchors discuss analysts’ views of individual stocks. Hence, investors have this information prior to the news segment. If there is a significant price impact of the news segments, this is direct evidence against the EMH.

Identifying the price impact of TV news

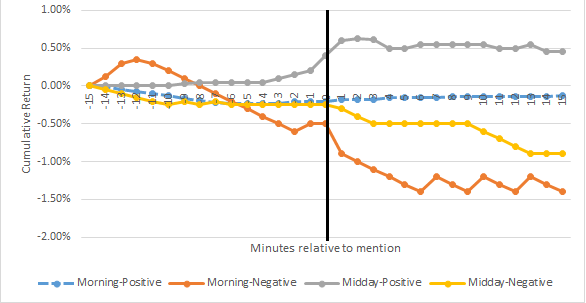

How do Busse and Green identify the price impact? They study stock prices over a 20-week period between June 12 and October 27, 2000, covering 322 reports on 84 trading days. To measure the impact, they compute cumulative stock returns in the 30 minute interval around the mention in the news segment. Figure 1 (reproduced from the original article) displays the results:

Figure 1: Price impact of TV news, reproduced from Busse/Green (2017)

As Figure 1 shows, positive news in the morning call (blue lin) have almost no impact. In contrast, negative news in the morning segment (orange line) have a gradual but persistent impact on prices: Stock returns decrease by -29 bps within the first minute, and -93 bps within the first 15 minutes (relative to the time-0 return).

Popularity matters!

In contrast, the response to the midday call of the more popular and experienced news anchor is much higher: First, returns after positive news (grey line) equal 41 bps for the 1-minute interval relative to the time-0 return. Second, the response to negative news (yellow line) is -23 bps for the one-minute and -75 bps for the 15-minute interval.

The take-away: TV news affect financial markets

In conclusion: Stock markets are not informationally efficient. Even publicly available information (here: analysts’ reports) affects prices when it is broadcast in a TV news segment.

You may also like