In a recent post, we discussed the Oehmke and Zawadowski (2017) paper. The authors identify hedging, speculation, and arbitrage as the main CDS trading motives. We now zoom in on one of these motives: hedging. The article “Mitigating Counterparty Risk” by Yalin Gündüz links the two phenomena “hedging” and “counterparty risk” – which we have discussed in a number of posts.

Buying protection, and then?

What do banks do after buying protection from another market participant through a CDS? As we discussed previously, low-risk protection sellers are attractive counterparties because they can make the compensation payment if a credit event takes place. If banks worry about the default of their counterparty, they may want to buy protection on these as well – again through a CDS.

German focus

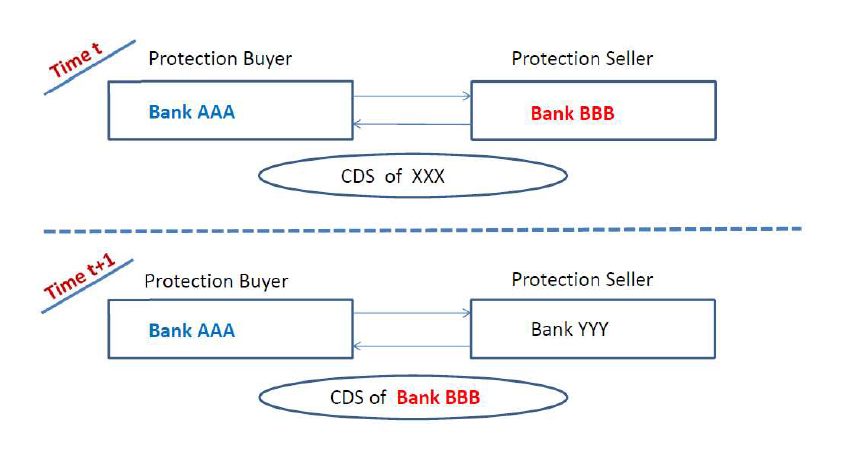

Gündüz considers CDS transactions where either one counterparty or the underlying reference entity is German. For these trades, market participants buy significantly more protection on a dealer after they have bought protection from that dealer. Figure 1 illustrates this counterparty risk mitigation technique.

Figure 1: Banks’ counterparty risk mitigation. Source: Gündüz, 2016, p. 30.

At time t, Bank AAA buys protection on underlying XXX from Bank BBB. At time t+1, Bank AAA buys protection on Bank BBB from Bank YYY to hedge against the counterparty risk of Bank BBB.

The economic magnitude

How much do banks hedge? Gündüz documents a ratio of 4-15%. This seems low, but it is sensible: CDS transactions are highly collateralized, and hedging is an additional precaution. Additionally, banks avoid wrong-way risk: they choose counterparties from different countries in the two transactions.

Counterparty risk mitigation: Better double-safe than sorry

The results show that banks use CDS twice: First, they buy CDS to hedge credit exposures. Second, they buy CDS to hedge against the new exposures this creates. To ensure the effectiveness of their hedge, they avoid wrong-way risk.

Can central clearing help?

Central clearing could make the second trade unnecessary: Optimally, a central clearing counterparty (CCP) is so safe that investors need not hedge against its default. This allows investors to save on transaction costs, and increases operational efficiency. As a result, the trading volume and liquidity of the CDS market could increase. On the other hand, a CCP may require more collateral from investors to ensure its own stability. This could offset the decrease in transaction costs.

Reducing complexity

At the very least, “outsourcing” counterparty risk management to the CCP makes CDS trading less complex and allows CCPs to act as specialized “counterparty risk managers”. Economic theory often stresses the importance of specialization and division of labor – so maybe this approach can improve counterparty risk management.

You may also like